Part 1 ~ Human Capital Input is the FIRST determinant of Economic Growth

An effective way to innovate HR, or any profession, is to deconstruct it and rebuild it with the building blocks of another profession.

Macroeconomists understand the drivers of economic growth and its three main determinants, (1) labor inputs, (2) financial inputs and (3) productivity. Furthermore, productivity is a function of ability and motivation.

- Do employees have the tools to increase labor output? (technology)

- Do employees have the motivation to increase labor output? (incentives)

Leveraging tools to increase labor output is a function of technological advancements through IT departments. Leveraging the incentive plans, organizational and job designs, and a company’s culture to increase labor output is a function of advancements in the science of human capital through the HR department.

In today’s knowledge economy, HR is the last person standing as a competitive differentiator.

This macroeconomic equation can be found in most economic courses and reveals that HR owns at least half of all economic growth. HR is accountable for one hundred percent of the first multiplier, labor input, none of the second multiple, financial input, and conservatively, we are accountable for at least half of productivity.

Macroeconomics confirms HR drives at least half of a firm’s economic growth.

Technology brought into a firm is either externally acquired or internally developed, the former via analysis and judgement of people, and the later, through the KSA’s (knowledge, skills & abilities) of people. Consequently, we can make the aggressive argument that HR is accountable for both human capital stock and productivity. However, this is not a contest and we are merely qualifying our argument using macroeconomics as a vehicle to alter the HR mindset. Consequently, we prefer to say that half of productivity is due to an IT department’s responsibility for in-house technology while HR owns the other portion of productivity through its (1) job design, (2) organizational effectiveness, (3) how it leverages culture, and most importantly, (4) how it uses choice architecture in its compensation plans. (Choice architecture is the second HR Truth in our series.)

When HR realizes they are accountable for half of its firm’s financial growth, defined not self-referentially through HR, but via the economic growth equation, the mindset of our profession is radically altered.

Part 2 ~ Financial input is the SECOND determinant of Economic Growth

Occupational sociologists tell us that many professions use techniques to maintain a heightened view of their profession comparative to other occupations. Using occupational specific jargon instead of laymen terminology to obscure meaning otherwise accessible to outsiders is one technique. Requiring licensing and certifications, both increasing barriers to entry, are another. The more exclusive a profession becomes in regulating their supply, the higher the intersection point on price against demand for that profession. Professionals cannot always increase their price points by manipulating external demands for their skills, occupational sociologists say, but they can far easier influence supply.

CEOs keep score using Net Income. HR needs to do the same.

HR, though, is unique in that instead of taking an inflated view of itself, it is one of the few professions that deflates its importance by failing to see its overall part in the value chain. The economic growth equation is just one example. Jack Welch spent years leading the HR revolution inside of his company. Welch believes that HR, even above finance, is the most important function in a company. It is both poignant and fundamental that instead of HR making the business case to convince Jack Welch of HR’s importance, it was the CEO of General Electric himself making the argument. It is poignant because when HR becomes too self-referential, defining its own success within HR metrics, it misses just how big the profession really is and leaves it to others to define it. It is fundamental because only a businessperson, like a CEO and not an HR person,, could grasp that HR is the most important function inside a company.

We have always maintained the undisputed premise that being an HR professional and being a business professional with subject matter expertise in HR are fundamentally different things requiring different core competencies. This distinction is perhaps worthy of distinct job titles; it’s undeniably worthy of different price points in the market.

In our asset-light knowledge economy, with all the tools we use commoditized — your competitors downloading the same software on the same hardware as you are — what else are companies competing on other than people? That is why we contend that HR is the last field of competitive advantage. HR understands labor input or human capital stock as the first determinant in the economic growth question. HR, though, is not accountable for the second determinant, financial input, also referred to as capital stock. Notwithstanding, the businessperson with HR expertise will measure human capital against financial capital. We advocate that although HR is not accountable for the second determinant of economic growth, we should express the first determinant (human capital inputs) within the context of the second determinant (financial inputs).

Human Capital will never be commoditized like the hardware and software so ubiquitously in use today.

Finance is the lingua franca of business. Finance also comprises the bookends of business, telling us the budget to implement various initiatives on the frontend, while measuring its impact via proforma financial statements on the backend. If HR could express the first determinate of economic growth, labor input, within the context of the second determined, financial input, we radically increase the task significance of the entire HR profession.

Task significance is an HR term that quantifies or, at the very least, qualifies the impact employees have on other employees. Task significance refers to employee perception that their work-product lies on the critical path to the success of their coworkers — that their own work product — is significant to the organization. Task significance is powerful when HR deploys it to individual jobs, so how much more commanding is the concept as a meta-approach applied to our entire profession? On an individual job level, task significance is contingent upon employees viewing their work product along the value chain of the entire enterprise. It is awareness of the interdependency of specific tasks on each other. Applied as a macro-approach to the entire HR profession, it does the same by viewing HR as the first determinant of the economic growth equation that can be expressed, within the context, of the second determinant, financial input.

Task Significance: Do your employees know where they fit on the value chain and which financial ratios they impact?

To examine the relationship between labor and financial, let’s deconstruct these two determinants:

Labor Input: HR owns one hundred percent of the first multiplier of the economic growth equation. Broken down, the quality of labor input is dependent upon employee KSA’s, meaning, their knowledge, skills & abilities. Those KSA’s can be acquired via (1) external recruitment of talent or (2) internal development of talent.

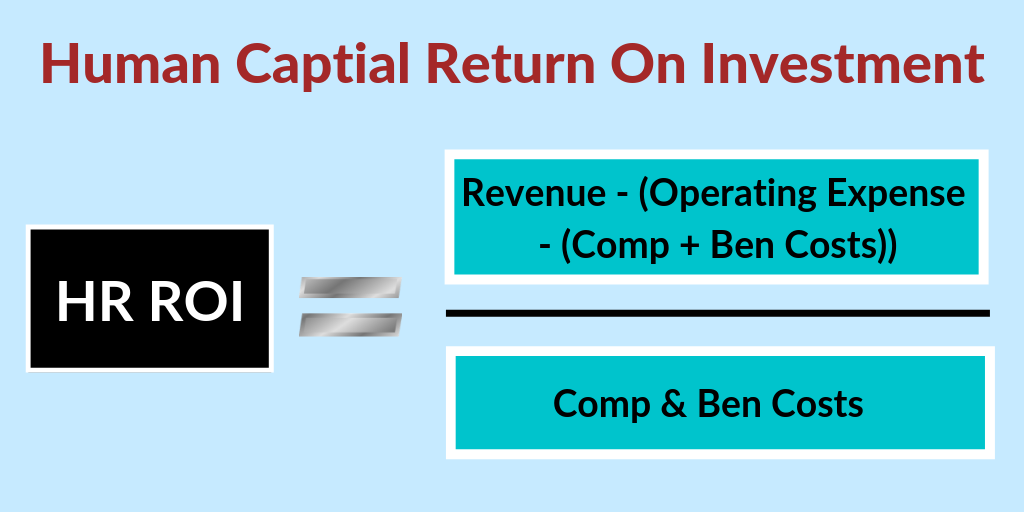

Financial Input: HR owns none of the second multiplier in the economic growth equation. However, this does not absolve HR from measuring its results within the context of financial input. An HR professional uses HR metrics, but a business professional, proficient in HR, uses the metrics of the language of business – finance! There is a plethora of customized metrics to measure labor input against financial input. We will offer a few standard examples to illustrate the point: (1) Human Capital Return on Investment (2) Human Capital Value Added, and (3) Human Economic Value Added.

Why is expressing HR metrics as financial metrics vital? Because it increases the integrity of CEOs who say people are their most important asset. Assets are recorded on a balance sheet; expenses are recorded on the income statement. When CEOs make the pronouncement that people are their most important asset, they open themselves up to the question as to why then, are their most important assets, people, only measured as expenses on the income statement when they could also be measured as the valuable assets they claim on a proforma balance sheet? Human-capital-financial ratios are prerequisite tools to create pro-forma financial documents. When human capital and financial ratios are expressed as a single metric, the CEO can now say people are our most important asset and back up the claim with her proforma balance sheet.

HR can only credibly call itself a business discipline when it measures its success against financial metrics.

And let’s look at the word proforma. Do you remember the lesson from occupational sociology about opting out of layman terminology to use specific occupational jargon instead? Well, proforma means hypothetical. That’s right, proforma basically means pretend! But which sounds more impressive? Based on the latest projections, you have update the “pretend balance sheet” or “proforma balance sheet”? Words shape our emotional reactions and because the term proforma balance sheet may conceal just how easy it is to calculate. This unproductive fear can scare off most HR professionals from developing their own proforma financial documents as the most powerful tool in their toolkit.

There are even more effective ways for HR to express labor inputs within the context of financial inputs. Just as we used macroeconomics to deconstruct the HR profession, let’s now turn to financial management itself to deconstruct their own internal financial ratios. Because ratios are constructed of individual metrics, it is a simple matter of reverse engineering to deconstruct them back to their original subcomponents. It is the individual metrics within an overall financial ratio that HR can connect to the Duties & Responsibilities section on all Job Descriptions.

The possibilities are interminable, but we will offer one illustrative example. The traditional Return on Asset Ratio or ROA is defined as net income divided by total assets. But what if we deconstructed the equation to its fundamental building blocks.

Use deconstructed financial ratios to link job performance to leading indicators of shareholder value.

The red numerator and denominator define the ratio. Net income can be broken down to more elementary parts while assets can be deconstructed to more fundamental parts as well. (See the illustration above.) Although beyond the scope of this article, we could further breakdown these individual subcomponents to their respective work-products as required to link them to specific job descriptions. This is what we do when we map out the entire value chain of an organization, tying work-products to metrics, and metrics to their relationships on profitability.

Once we deconstruct enough financial ratios – and there are many to choose from – HR can then link every subcomponent to individual duties & responsibilities on respective job descriptions. Through this approach, HR can quantify – not merely qualify – to individual employees how much their work product contributes to Return On Assets. Because ROA is a leading indicator to the ultimate lagging indicator, net income, HR now has a new profit-centric tool for organizational effectiveness and design.

When CEOs say people are our most important asset, the remark has credibility when HR can measure the first economic determent – capital stock – on a proforma balance sheet.

Another simple illustration may include HR providing Six-Sigma training to the production team. Whether creating goods in the manufacturing economy or software in the knowledge economy, a probable result of Six-Sigma training is reduced defects resulting in a decrease in the cost of goods sold (COGS). HR can now tell the Chief Operations Officer the extent of Six-Sigma training’s impact on Return on Assets by virtue of increasing the ROA numerator by reducing costs. HR can automate software to measure an individual salesperson’s or production manager’s impact on different financial ratios or even entire departments. The HR function itself, after initiating a new program to increase productivity, may only need to fill 70% of previous vacancies due to increased efficiencies. For this illustration, this productivity initiative increases the ROA numerator by decreasing SGA costs. HR can now measure its reduced comp plan’s impact on return on assets – or any other ratio considered a vital leading indicator to profitability.

If HR only measures people as an expense on the income statement, then the slogan people are our most important asset rings hallow.

From a plethora of financial ratios combined with various combinations of deconstruction, there are indeterminate possibilities of how to utilize this new HR tool. All job descriptions should quantify their task significance by linking the work-product described under the duties & responsibilities clause to the individual metrics that make up respective financial ratios.

When human-capital-financial ratios are routinely used by every HR manager, HR finally becomes the business discipline CEOs have always needed it to be.

It is an easy thing to merely say that HR person should create shareholder value. This article demonstrates that it is straightforward to quantify this value by linking financial ratios to job descriptions. Going back to the macroeconomic growth equation, this is how HR can articulate the equation’s first determinant (human capital input) within the language of the second determent (financial input). Is there a possible argument why HR should not express its accomplishments in the lingua franca of business?

Part 3 ~ Productivity is the THIRD determinant of Economic Growth

The third determinant of the economic growth equation is productivity. The first question HR asks when an employee is failing is if it is a matter of (1) ability, requiring training and development, or a matter of (2) motivation, requiring adjustments in the comp plan via incentives presented in its choice architecture. This premise holds true for the third determinant, productivity, as well. Productivity is a measure of efficiency. Help desk call centers often quantity their metrics via different variable outputs per shift. Reducing customer queue time or increasing customer first call resolution by increasing headcount may be an example of scalability but it is certainly not an example of increased productivity. Increasing those same two metrics by maintaining or even decreasing headcount certainly is an example of increased productivity.

HR is responsible for at least half of a firm’s productivity as defined in the third determinant of the economic growth equation.

So how does productivity, as our third determinant of economic growth, work when applied to companies? Think of technology as a fulcrum, increasing outputs without increasing inputs or, at the very least, increasing outputs disproportionately higher than a corresponding increase in inputs. To increase revenue, for example, without increasing headcount or billable hours, would be the result of increased productivity.

Certainly, at least half of productivity is owned by the Chief Technology Officer. But productivity is just as much a function of the way individual jobs are designed. Broadening our scope to the way all jobs are holistically designed and integrated along the value chain, the whole idea behind organizational effectiveness is to optimize efficiencies in how firms achieve their outcomes.

Choice architecture, to be discussed in the next HR truth, plays the indispensable role in increasing employee motivation to find never-ending ways to improve productivity. The calculus of productivity also includes how HR leverages and sustains company culture to achieve company-wide outcomes. Consequently, respecting the contributions of both technological advancements and the role HR plays in (1) job design, (2) organizational effectiveness, (3) incentive pay plans and (4) leveraging culture, we posit that while IT is accountable for half of productivity, our beloved profession is accountable for the other half.

Our Conclusion:

HR, as a profession, becomes bigger than itself when it is both viewed through the mind of a macroeconomist and measured through the eyes of a financial manager.

When we view HR through the economic growth equation, workforce multiplied by financial capital multiplied by productivity – when we view our profession through an equation that might be found in any macroeconomic textbook – we articulate, via a business argument, why HR is vital to economic growth — not defined by ourselves — but by macroeconomics.

Pre-IPO startup companies usually do not have an independent functioning HR department. Although company founders may not view their choices as human capital decisions, even their success depends upon the most important function in their firm — HR!

To be a businessperson with expertise in HR, instead of merely an HR person, is to raise the task significance of our entire profession.

Vincent Suppa works with startups and investors and teaches graduate courses at New York University. His email is suppa@suppa.org.

© Vincent Suppa 2019